Instant Asset Write-off Increased to $150K, Corresponding to up to $45K in Tax Credits for Australian Businesses

Amongst the coronavirus issues which can be tough for us personally or business-wise, we would like to pass on some encouraging news.

Recently (Thursday,12th March 2020) the Australian Government announced an economic response totalling $17.6 billion across the forward estimates. This package is expected to protect the economy by maintaining confidence, supporting investment and keeping people in jobs. Additional business support will flow through to strengthen the wider economy.

This includes the Government lifting the ‘Instant Asset Write-off’ threshold to $150k (from $30k) effective immediately and continuing to June 30, 2020 [now extended to December 31, 2020!]. That's equivalent up to $45,000 in tax credit, and can be used for solar and energy efficiency equipment^.

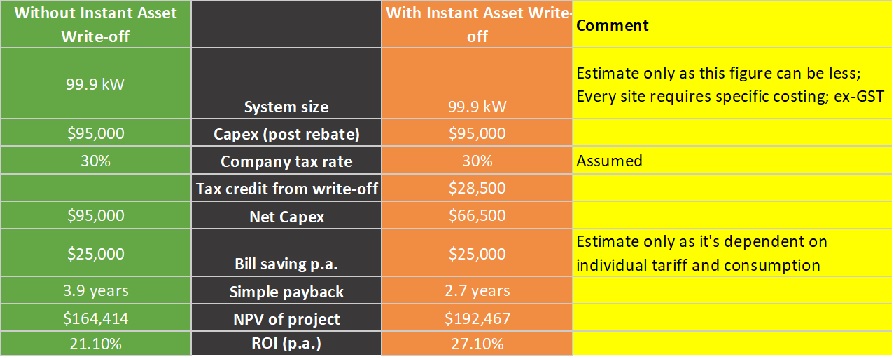

Here is a practical example on a large 99.9kW system:

I.e. a boost on payback and return on investment can be observed as a result of this write-off

If investing capital is not preferred, then we can help you with Solar Chattel Mortgage option where you get additional benefits below:

• GST can be funded by the Chattel and claimed back from the ATO in the next BAS

• Interest claimed back on P+L

• $0 residual

For the above example, it means be cashflow positive (payments less than energy savings) plus cashflow saving for your business of $38,000 ($28,500 tax credit and $9,500 GST).

Critical: The system must be operational by 31st December 2020 to qualify for the 100% write off. The grid connection approval process may cause commercial installations taking about 4 months to complete. In addition, currently there’s limited stock of tier-1 solar panels in the country due to coronavirus issues disrupting supply.

Why not use this rare opportunity to protect your business from further uncertainties by controlling a large portion of your energy costs through generating your own power?

Please email eric@freeengineer.com.au now if you’d like more info.

Let’s keep our hope and faith while moving forward in this unprecedented season.

P.S. ^Based on a 30% Company tax rate. These figures are for illustrations only, hence customers should seek their own accounting advice. Businesses with aggregated annual turnover of less than $500 million can now be eligible.

For more info, refer here:https://www.business.gov.au/risk-management/emergency-management/coronavirus-information-and-support-for-business/instant-asset-write-off