Should a Business Go Solar Now or Wait for Battery Costs to Come Down before Going Solar?

Did you know that in 2017-18 many of our commercial clients have been shocked by increase to (up to) 3x of previous rates when looking at renewal of their electricity contracts? Energy has been on the news so often recently: Hazelwood closure, grid issues and regulations, coal lobby group, changes in renewable energy scheme, politics on energy etc. These are such complex issues and outside of our control. How can a business owner/ manager protect profit and run a sustainable business? Why don’t we focus on what we can control: our own energy (electricity) reduction?

As specialist energy reduction engineers, our training and experiences enable us to analyse technical solutions, assess financial performance, identify and minimise risks as well as propose suitable solutions.

A number of business owners or managers expressed their uncertainty to us: My site consumes electricity at night as well for refrigeration or evening production shift. Hence, wouldn’t it make sense to put solar on hold until battery costs come down so we can get the full benefit?

We understand why they would think this way. Currently, the payback (PB) of solar + battery system can be up to 12 years or more. Only in a few cases a shorter payback of closer to 6 years is possible due to a few site-dependent factors. We agree with them that energy storage system costs are expected to continue to fall in the next 5 years or so. An interesting trend is the use of stationary batteries to store energy on commercial and industrial sites is on the rise. The main reason is that costs have fallen sharply (in the US)—from $1,000 per kilowatt-hour in 2010 to $230 in 2016, according to McKinsey research (from www.mckinsey.com).

The feed-in tariff offered by the retailers is relatively low which means many of us would prefer to use solar energy ourselves as much as possible.

Yet, 99% of the time the answer is NO. Going solar later most likely will cost an organisation a lot of money. Why?

CASE STUDY

Let’s compare through a case study of a real site we did feasibility on. Scenario 1 (going solar now) vs Scenario 2 (going solar after the battery costs have come down)

Site: food business in East Victoria

Blended peak rate: 32.3 c/ kWh; Blended offpeak rate: 18.5 c/ kWh

Consumption pattern: 24/7 with heavier use during the day

Proposed solar PV size: 150 kWp (thus not eligible for feed-in tariff)

Here’s a summary of the exciting spreadsheets done by our engineers because we know you may not find these as exciting as the engineers do… We assume that these below are through rental arrangement (fully tax-deductible) to avoid capital outlay. These nett benefits are after repayments or rental costs.

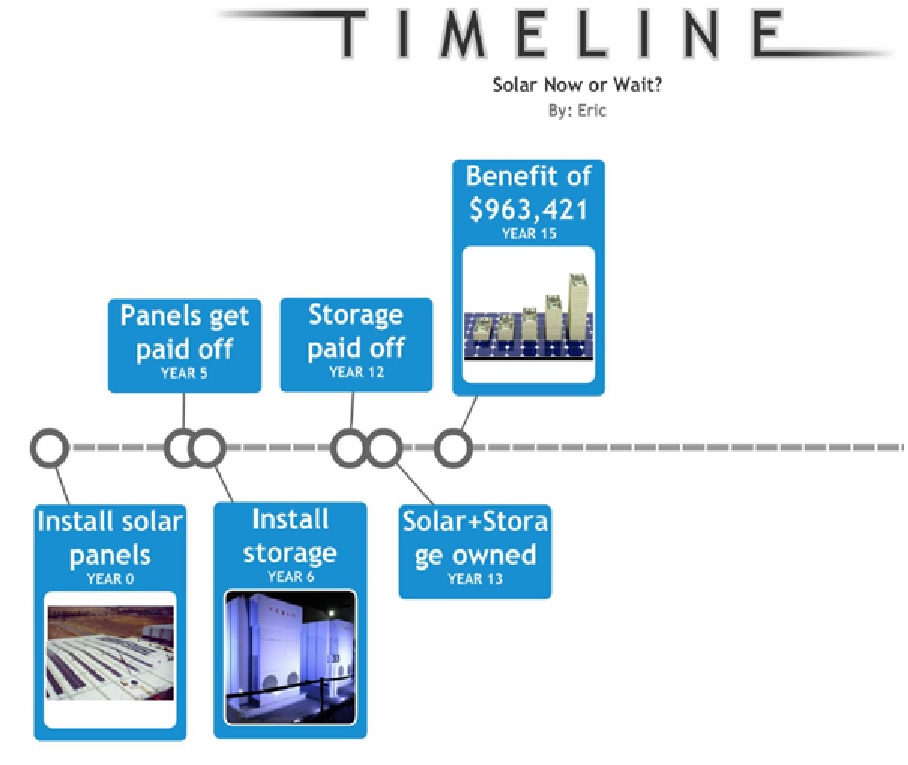

Scenario 1 - Solar first then storage once its payback has shortened

Estimates:

current PB for solar: 3 years

rental period (solar) to be cashflow positive: 5 years

current PB for solar + storage: 9 years

future PB for storage: 4.5 years

rental period (storage) to be cashflow positive:7 years

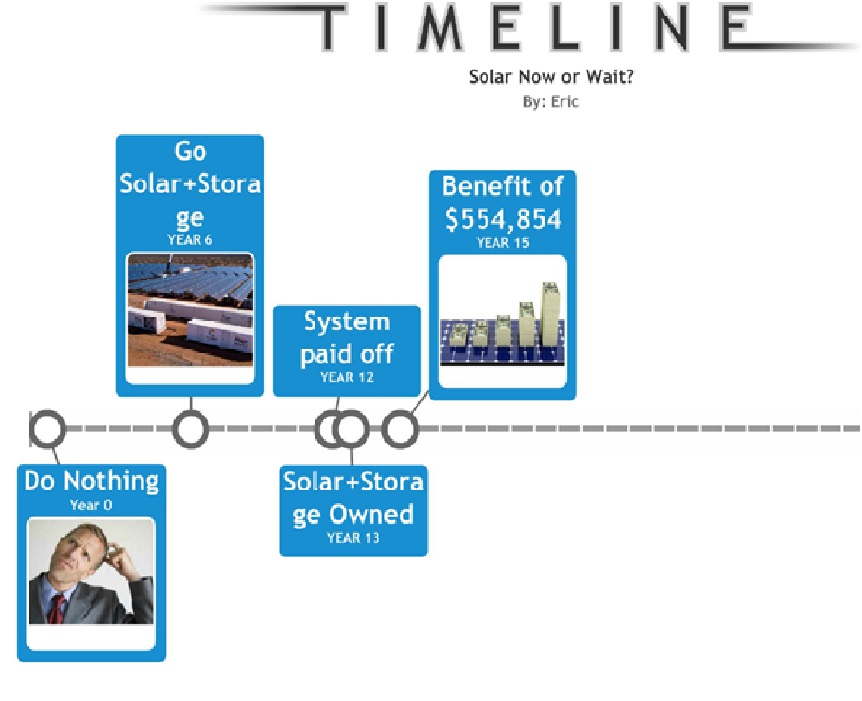

Scenario 2 - Wait for energy storage costs to come down before going solar

Estimates:

future PB for solar + storage: 5 years

rental period to be cashflow positive: 7 years

THE RESULT

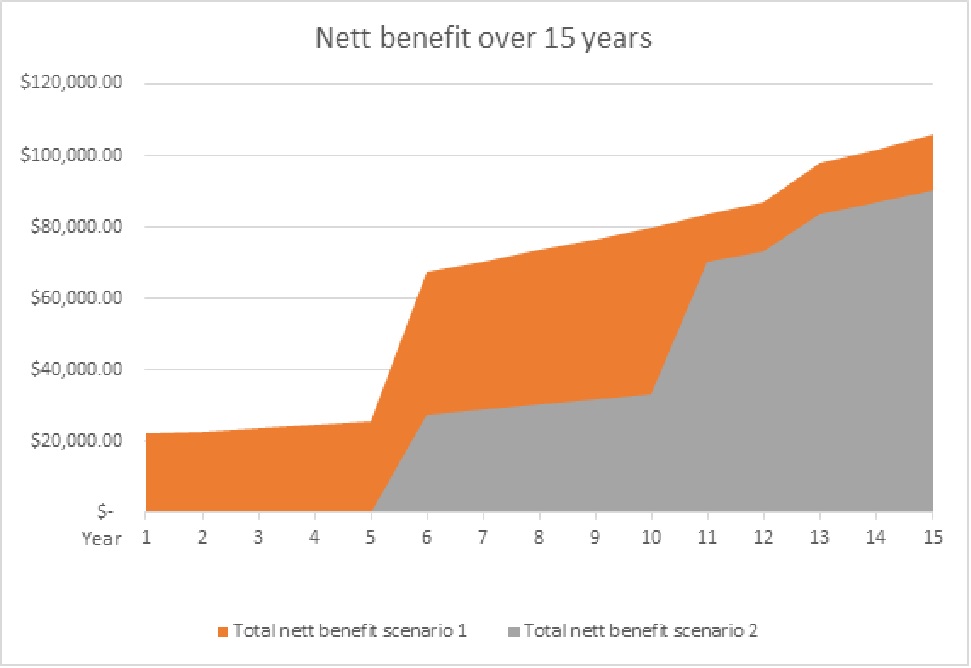

Comparing the benefits from Year 1 to Year 15, here’s the gap of the benefits:

If you were to go solar now, then the panels will have paid themselves off (become your significant asset) by the time you look at installing the battery 5 years down the track. You will have less rental or repayment outgoings and increase your savings then.

Financially, this means the cumulative costs of delaying going solar can be $963,421 - $554,854 = $408,567!!! Would these dollars be better in your pocket or the energy retailer’s pocket?

Hence, it is best for you to go solar now, as long as you choose the right battery-ready system.

Please book a free consultation with our engineers if you want to learn more now.

This is a complex analysis. Hence reasonable assumptions have been used to simplify such as:

• No export to the grid, all solar kWh will be either consumed directly or consumed through the storage system

• On average 20% of solar power generated will be stored for self-consumption later

• The benefits or payback of solar is not expected to drastically change in the near future because:

o PV panel technology is considerably mature now

o Price may fall again but not as drastic as the last few years

o The government is expected to continue winding back the incentive for solar as it has been the past couple of years - hence would be negative impact on solar benefits and payback

• Escalation of electricity price: 5% p.a. (it’s mild compared to the recent jump in energy prices)

Thank you for reading our blog. Please talk to us to learn more and share this with your contacts for their benefit.