Federal Budget: What’s in it for Your Business?

Touted as the most significant Federal Budget in the last few decades, 20-21 budget includes massive $27b tax breaks (through different schemes) for virtually all businesses, bar only 1 %.

One terrific change is the expansion of the Instant Asset Write-Off. Simply put, it now means bigger, better and more accessible tax credits!

The details available publicly as of 8th October 2020 are rather convoluted. What do Instant Asset Write-Off (IAWO), Accelerated Depreciation and Temporary Full Expensing all mean? We’ll simplify them for you below.

In short, eligible businesses with an aggregated turnover of less than $5 billion (expected to be 99% of Australian businesses) will be able to deduct the full cost of new eligible depreciating assets. These assets are to be first held, and first used or installed between 7:30 pm AEDT on 6 October 2020 and 30 June 2022.

These full cost deductions (let’s refer to it as IAWO for simplicity) currently have no limit on the value, unlike the pre-federal budget’s version of the Instant Asset Write-Off. And, it can be claimed across multiple assets.

The best example of a smart, sustainable asset that can provide a return for up to 25 years is a solar PV system. I admit we are a bit biased towards solar because we are so passionate about it and its benefits for our previous clients. If there’s another environmentally-friendly asset that can last up to 25 years with minimum maintenance, we’d love to hear it? Eligible businesses can get up to hundreds of thousands of dollars through solar or battery solution.

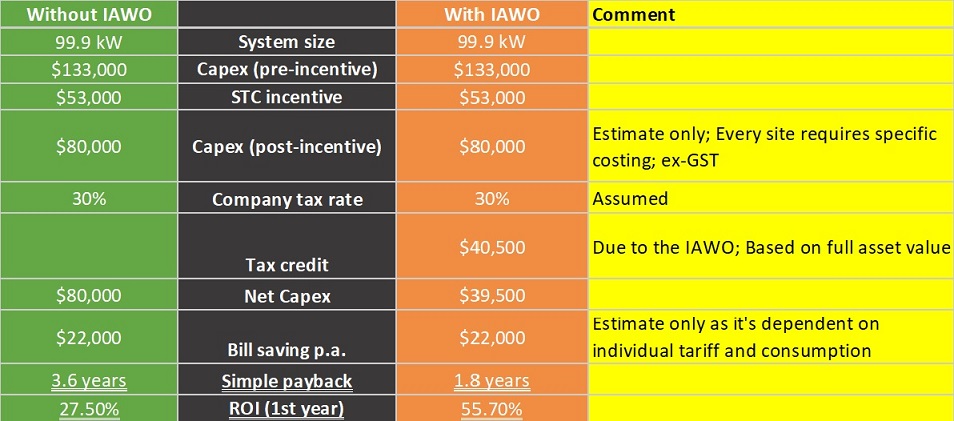

- Here is a practical illustration on how Instant Asset Write-Off enables a medium-size 99.9kW Solar PV to have a Return of Investment of 55.7%!

(If investing your own business capital is not preferred, then we can help you with a Solar Chattel Mortgage or similar option where you also get these following additional benefits):

• GST can be funded by the Chattel and claimed back from the ATO in the next BAS

• Interest claimed back on P+L

• $0 residual

For the above example, it means being cashflow positive (outgoing payments being less than the energy cost savings) plus cash flow savings of $48,500 for your business.

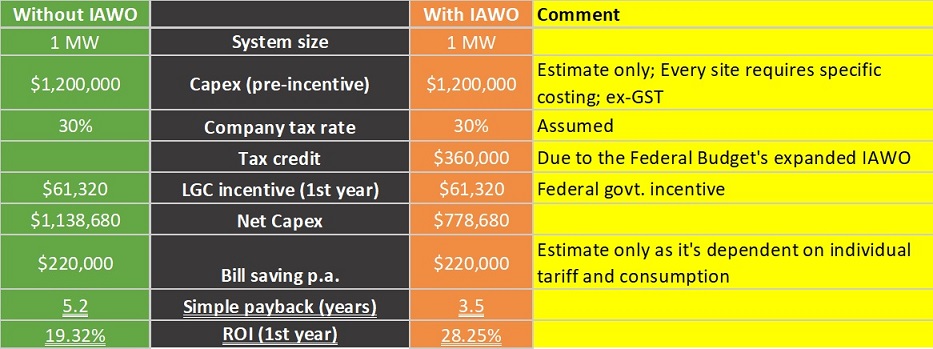

- Here is an illustration on $360,000 tax credits obtained through a large LGC system (1MW/ 1000kW):

This is undoubtedly the best time in Australia to consider solar given these never-seen-before payback and ROI figures. Furthermore, the federal government solar incentive reduces in 2021!

If you want to know more, then please let me know.

P.S. Based on a 30% Company tax rate. These figures are for illustrations only, hence customers should seek their own accounting advice. For more info: https://www.ato.gov.au/General/New-legislation/In-detail/Direct-taxes/Income-tax-for-businesses/JobMaker-Plan---temporary-full-expensing-to-support-investment-and-jobs/

*Subject to the passing of the legislation – expected around November 2020