Did You Miss the Most Important Latest Changes in Commercial Solar?

2017-2018 most likely marked the biggest boom for solar energy in Australia. A ‘perfect storm’ of rising energy prices, improved technology and cheaper equipment and install prices certainly have been the most significant drivers.

What does it mean to your organisation or business?

a. Short payback – We have done analysis for our large commercial and industrial clients resulting in close to 2.5 year payback

b. Previously, some organisations were not able to assign high priority to energy concerns. The shock of energy price crisis, such as in Victoria, then escalated the energy issue to the highest level of decision makers and boards of most organisations. This made a big difference to renewable energy (sustainability) champions within the organisations who are pushing for this positive change.

c. Trust in solar PV’s reliability from investment’s point of view is probably the strongest ever, making it in much demand in commercial environment

But the market shifted around Q2-Q3 of 2018. Unfortunately, most organisations struggle to grasp these. How would these important changes affect your business?

- Depending on how your electricity contract is aligned against the market’s peak and downward shift, your new rates might have improved recently, which could mean solar payback would extend a bit.

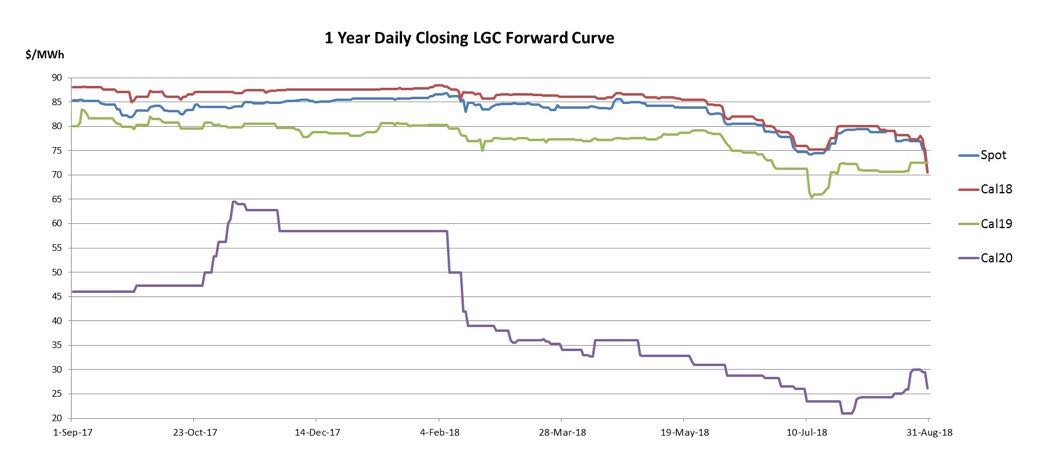

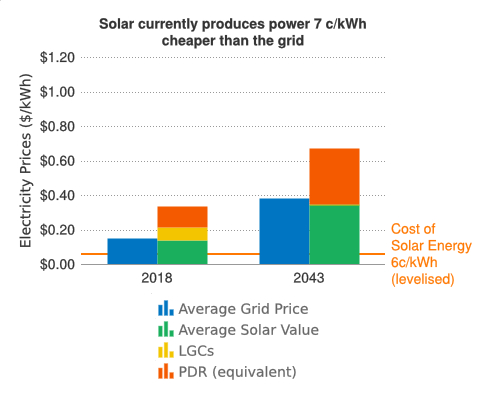

- Both STC (Small-scale Technology Certificates) and LGC (Large-scale Generation Certificate) incentives from the federal government (or loosely known as the solar rebates) are market-driven and expected to reduce in the near future. This means the projected saving and payback may look worse.

(graph from reneweconomy.com.au)

(graph from reneweconomy.com.au)

- The incentives are decreasing and may get abolished in a couple of years’ time in relation to recent political uncertainties around energy policies. How can you benefit in a timely manner?

Does it mean solar is now out of the window for you? Not necessarily because you would be making decision without knowing all the facts and figures such as:

- We are still seeing sites that have Return-on-Investment of more than 35% and payback of less than 3 years.

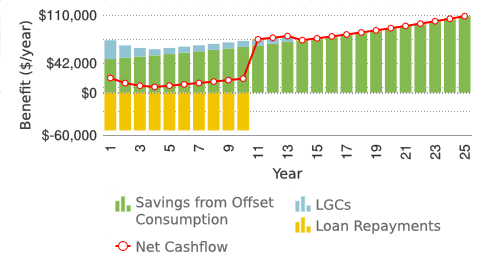

- More importantly, there are proven ways to structure projects where the solar panels can pay themselves off plus the benefit of tax depreciation or 100% tax deduction*, hence $0 outlay. In addition, further fall in equipment prices due to a few factors have counter-balanced the above. Illustrations from a recent project below:

- There are ways to get upfront solar rebates or hedge the certificate values to maximise the rebates.

Solar companies (installers) may or may not represent the above accurately for one reason or another. If you are a decision maker or presenting solar to the decision makers, how can you cover yourself or manage the risks? How can you model this accurately? The below are strongly recommended:

• Use data-driven approach to analyse the design and financial modelling

• Careful sizing of solar systems as it affects your payback and saving

• Engage third-party engineers to help you understand the scope and process of commercial solar project such as load analysis, switchboard modification costs as well as grid connection process and costs (a highly technical process)

• Comprehensive research on the installers – solar companies come and go in this volatile market

• Well-planned procurement, supplier selection and negotiation process

*Need further assessment

Free Engineer can help – All you need is request a free energy assessment Now