(1) Instant Asset Write-off Extension + (2) Accelerated Depreciation – What Do They Mean to Your Business?

As the economy is restarting again and looking more positive, the Australian Government recently (9th June 2020) announced the extension of 6 months (until the End of 2020) for the Instant Asset Write-off to further support Australian economic recovery.

Under this Rule, a 100% Tax Deduction is allowed for capital expenditure on assets up to $150,000.

On top of that, the Accelerated Depreciation Deduction can be applied to assets with a cost (or adjustable value if applicable) of $150,000 or more. The amount an eligible entity can deduct under this Rule is:

• 50% of the cost of the depreciating asset

• plus the amount of the usual depreciation deduction that would otherwise apply but calculated as if the cost or the adjustable value of the asset was reduced by 50%.

These two generous Tax rulings are available to businesses with less than $500 million annual revenue, and mean they can get up to hundreds of thousands of dollars in tax credits for eligible assets, including solar and energy efficiency equipment^.

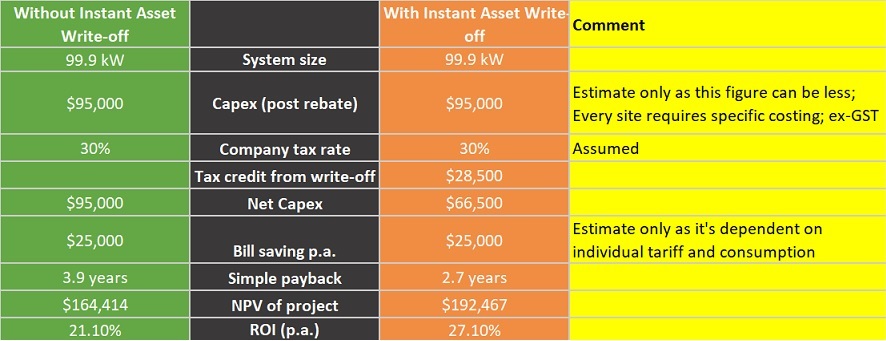

1.Here is a practical example of the Instant Asset Write-off on a medium size 99.9kW Solar system:

(If investing your own business capital is not preferred, then we can help you with a Solar Chattel Mortgage or similar option where you also get these following additional benefits):

• GST can be funded by the Chattel and claimed back from the ATO in the next BAS

• Interest claimed back on P+L

• $0 residual

For the above example, it means being cashflow positive (outgoing payments being less than the energy cost savings) plus cashflow savings for your business of $38,000 ($28,500 tax credit and $9,500 GST).

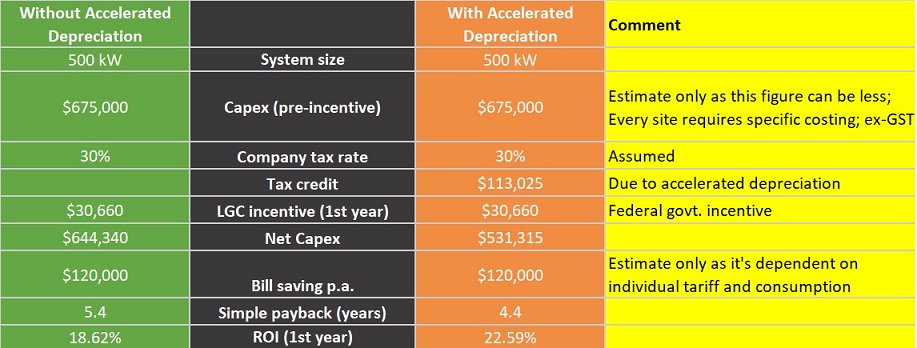

2.Here is a practical example of accelerated depreciation on a large LGC system (500kW):

I.e. a boost on payback and return on investment can be observed as a result of these depreciation rules.

Critical: Please note the system must be operational by 31st December 2020 to qualify for the 100% Instant Asset Write-off.

The grid connection approval process may cause commercial installations taking about 4 months to complete. In addition, currently there’s a limited amount of available quality installers due to the solar rush resulting from the above incentives. Why not use this rare opportunity to protect your business from further uncertainties by controlling a large portion of your energy costs by generating your own power?

Please email eric@freeengineer.com.au now if you’d like more info.

P.S. ^Based on a 30% Company tax rate. These figures are for illustrations only, hence customers should seek their own accounting advice.

For more info: